The Client

| Name | Dr. Jordan D. Frey, MD |

| Specialty | Plastic Surgery |

| Location | Buffalo, New York |

| Business/Platform: | Founder, The Prudent Plastic Surgeon |

Dr. Jordan D. Frey, MD, is a board-certified plastic surgeon based in Buffalo, New York. As the founder of The Prudent Plastic Surgeon, he combines his medical expertise with a passion for financial literacy, helping fellow physicians build financial independence while balancing his thriving practice, family life, and teaching commitments.

The Situation

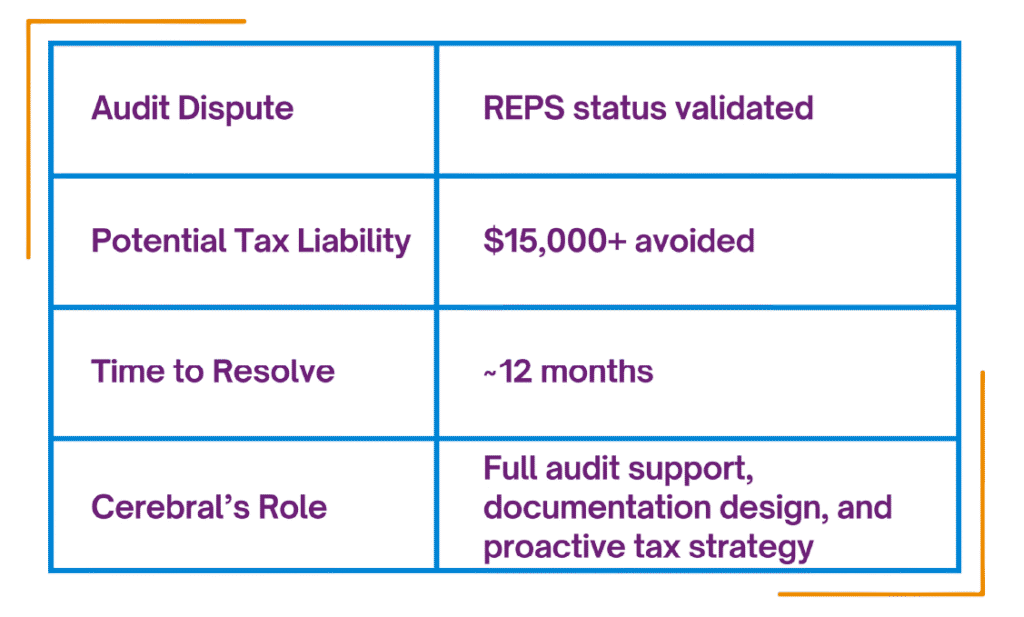

Despite being diligent about financial and tax planning, Dr. Frey and his wife, Selenid, received an unexpected audit notice from the New York State Department of Taxation regarding their 2021 state tax return. The state disputed Selenid’s qualification for Real Estate Professional Tax Status (REPS), a designation allowing real-estate professionals to offset active income with real-estate losses.

If the audit findings held, the couple could have owed over $15,000 in additional taxes.

The challenge wasn’t just financial, it was emotional. Dr. Frey and his wife knew they had complied with the law, but they needed to prove it beyond any doubt.

The Solution

- Handled all correspondence with New York State, ensuring accuracy and timely responses.

- Created a custom tracker to re-document Selenid’s 900+ hours of real-estate participation.

- Compiled evidence, contracts, pay stubs, emails, photos, and handwritten logs, into a clear, defensible package.

- Guided future documentation practices to strengthen audit readiness and peace of mind.

Throughout the process, Cerebral provided reassurance, expertise, and proactive communication, turning what could have been an overwhelming experience into a successful resolution.

The Results

After nearly a year of back-and-forth, the audit concluded with no back taxes owed. The case was resolved fully in the Freys’ favor, avoiding more than $15,000 in potential taxes.

The experience also reinforced the value of proactive tax planning and thorough documentation. Dr. Frey continues to partner with Cerebral for year-round tax strategy, ensuring his growing income, real-estate investments, and business ventures remain optimized and compliant.

Why Cerebral

Audit Protection & IRS Representation

Every Cerebral client is covered by our Audit Protection. We handle notices, manage deadlines, and represent you before the IRS or your state so you don’t have to do it alone. Our team uses Audit-Ready strategies and only takes positions we’re prepared to defend.

Why NTPI Fellow Matters

Founder and Lead Strategist Alexis Gallati holds the NTPI Fellow designation, earned through the NAEA’s rigorous three-year program in IRS examinations, collections, and appeals. This advanced training enables Alexis to represent clients in front of the IRS and navigate complex cases efficiently and confidently.

Key Lessons from Dr. Frey’s Experienceral

1. Document everything:

Keep detailed, organized records of hours, transactions, and strategies.

2. Partner with experts:

Work with experienced tax professionals who understand complex regulations and audits.

3. Be proactive:

Plan ahead, follow the rules, and audits become a formality, not a fear.

You can read more details about this experience directly from Dr. Frey on his blog, The Prudent Plastic Surgeon, here: https://prudentplasticsurgeon.com/tax-audit-lessons/